Unemployment For Employers

Only three statesAlaska New Jersey and Pennsylvaniaassess unemployment taxes on employees and its a small portion of the overall cost. Unemployment Information For Employers.

Workforce West Virginia Steps For Employers

Workforce West Virginia Steps For Employers

Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD.

Unemployment for employers. Welcome to the Maryland Division of Unemployment Insurance BEACON Application. Tennessee law requires unemployment claimants to accept suitable work when offered by an employer or risk disqualification from the unemployment benefits program. Use our Online Claims System to apply for benefits.

Oklahoma Employment Security Commission. Scale Your Career at Magento Agency - Full Stack Developer Jobs Available for London UK. Ad Through partnerships with the leading job boards we have over 8 million job postings.

405 557-7100 Telecommunications Device for the Deaf TDD. Unemployment Insurance Appeals - guide to the appeals process FAQs Internet appeals filing board decisions statutes regulations on-line hearing docket and more. A Registration and Seeking Work Waiver may now be requested on-line.

In the past employers had to submit the request in writing and receive approval for the waiver request. The WorkShare program is an alternative for employers faced with a cut in workforce. Learn about your responsibilities.

If you are an existing employer accessing BEACON for the first time you will need to first activate your account. Federal Unemployment Tax Act FUTA and State Unemployment Tax Acts SUTAs require employers to pay unemployment taxes to the federal government and their state agency. Unemployment taxes are paid by employers to the federal government and states in order to fund unemployment benefits for out-of-work employees.

If you cannot file online call 1-877-FILE-4-UI 1-877-345-3484. Employers experiencing a slowdown in business as a result of the coronavirus impact on the economy may apply for the Arizonas Shared Work Program. This means the maximum youll pay per employee is 420.

If you file for benefits your employer will be notified if you file a claim. The Unemployment Insurance Agency UIA has made it faster and easier for employers to request a Registration and Seeking Work Waiver for short term lay off periods. Employees are able to receive part of their unemployment insurance benefits while working reduced hours and being paid for those hours by their employer.

If youre currently employed you are not eligible for unemployment benefits unless your hours have been reduced or there are other circumstances that have impacted your job. This program gives employers an alternative to layoffs and allows the retention of trained employees by reducing their hours and wages that can be partially offset with UI benefits. Unemployment Insurance Tax Information.

What Employers Need to Know About the Unemployment Program. Unemployment Insurance UI for Employers. PO Box 52003 Oklahoma City OK 73152-2003.

405 525-1500 Administrative Offices. Employers can divide available work between affected employees instead of laying off workers. The rate charged its called a tax is based on the type of business.

Ad Through partnerships with the leading job boards we have over 8 million job postings. Unemployment Insurance UI benefits are available to workers who are unemployed or have reduced hours and meet eligibility requirements. The unemployment program for employers works like insurance meaning that employers pay for the coverage.

Unemployment is almost entirely funded by employers. No matter what state you are located in youll need to pay set FUTA taxes which amount to 6 of the first 7000 each employee earns per calendar year. Scale Your Career at Magento Agency - Full Stack Developer Jobs Available for London UK.

Unemployment Insurance Handbooks for Employers Publications to help explain the unemployment insurance program in. Marylands BEACON Unemployment Insurance Application. You qualify for relief of UI benefit charging if your employees were laid off due to the public health emergency declared by Executive Order 72 and filed initial unemployment claims for the weeks of March 15 2020 - March 13 2021.

UI benefits offer workers temporary income while theyre out of work or working reduced hours. These funds provide unemployment benefits for out-of-work employees. As an employer you may be subject to unemployment insurance.

All employers must register for unemployment insurance when they meet liability. You may file a UI claim the first week your employment stops or your work hours are reduced. If an employer notifies the agency an applicant who is receiving unemployment did not accept a job offer the agency will investigate the allegation.

Most businesses pay both Federal Unemployment Tax Act FUTA taxes and State Unemployment Tax Act SUTA taxes. Employers play an important role in providing unemployment insurance UI benefits to workers. Employers Guide to Unemployment Compensation PDF 119KB.

Unemployment is funded and taxed at both the federal and state level. Due to a recent law change you will not need to submit a request for charging relief. If you are a new employer and need to set up your account you will need to start by registering your.

3 Common Reasons Why Employers Lose Unemployment Claims

3 Common Reasons Why Employers Lose Unemployment Claims

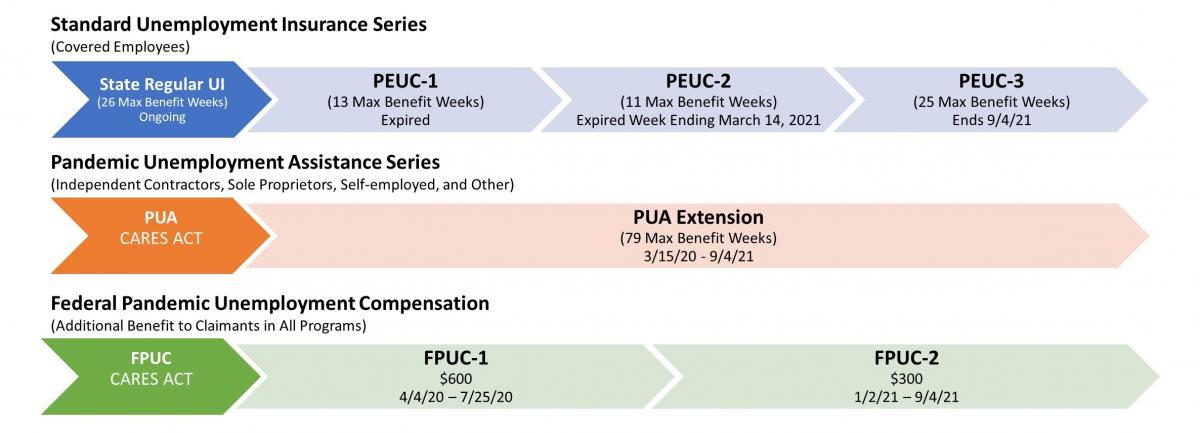

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Download Md Unemployment For Employers Free For Android Md Unemployment For Employers Apk Download Steprimo Com

Unemployment Insurance National Council Of Nonprofits

Unemployment Insurance National Council Of Nonprofits

Official Answers Questions About Applying For Unemployment Wbbj Tv

Official Answers Questions About Applying For Unemployment Wbbj Tv

Employers Face Staggering Hike In Unemployment Taxes

Employers Face Staggering Hike In Unemployment Taxes

Unemployment Insurance Department Of Labor

Unemployment Insurance Department Of Labor

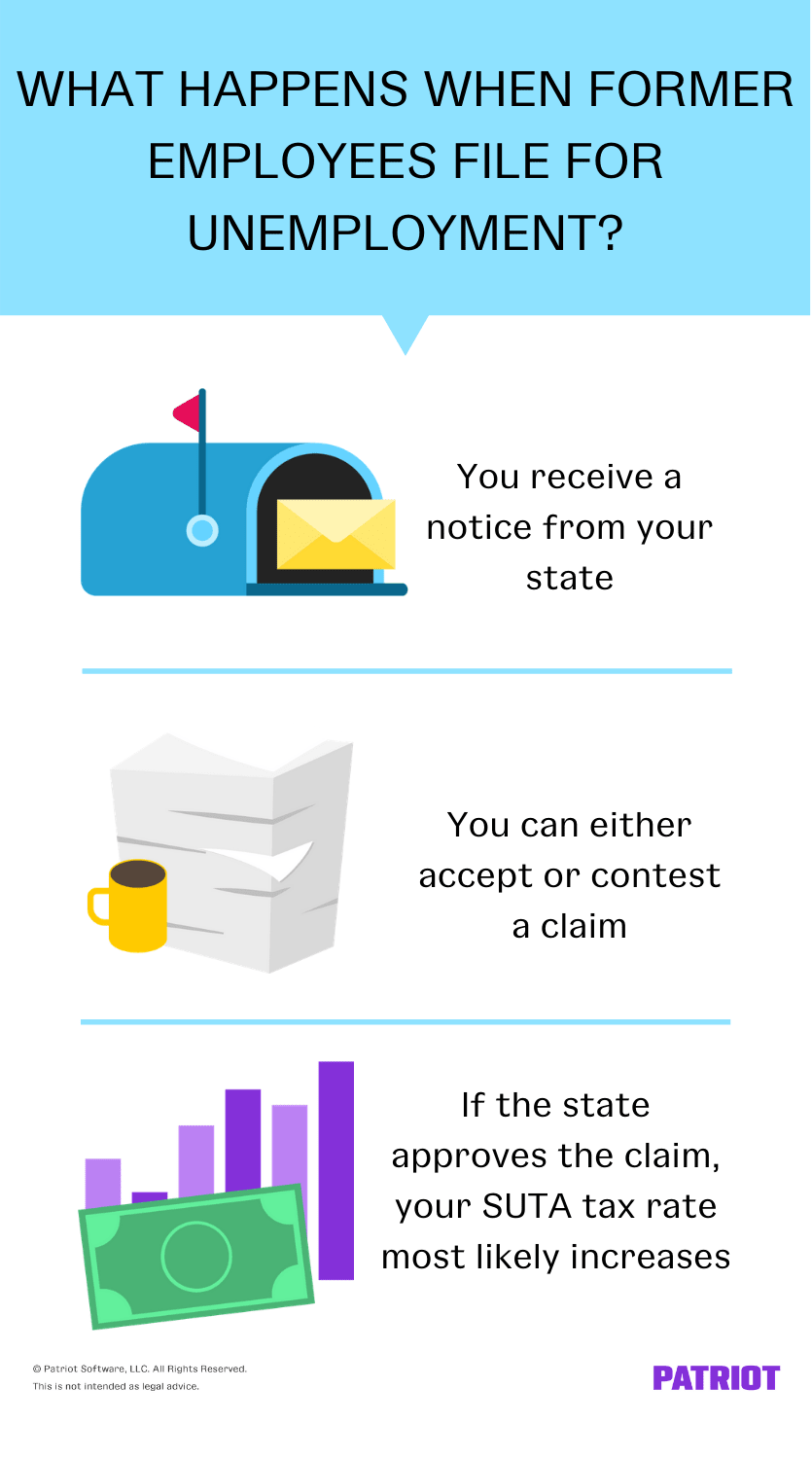

How Does Unemployment Work For Employers Handling Claims

How Does Unemployment Work For Employers Handling Claims

It S Essential To Respond To Unemployment Insurance Claims

It S Essential To Respond To Unemployment Insurance Claims

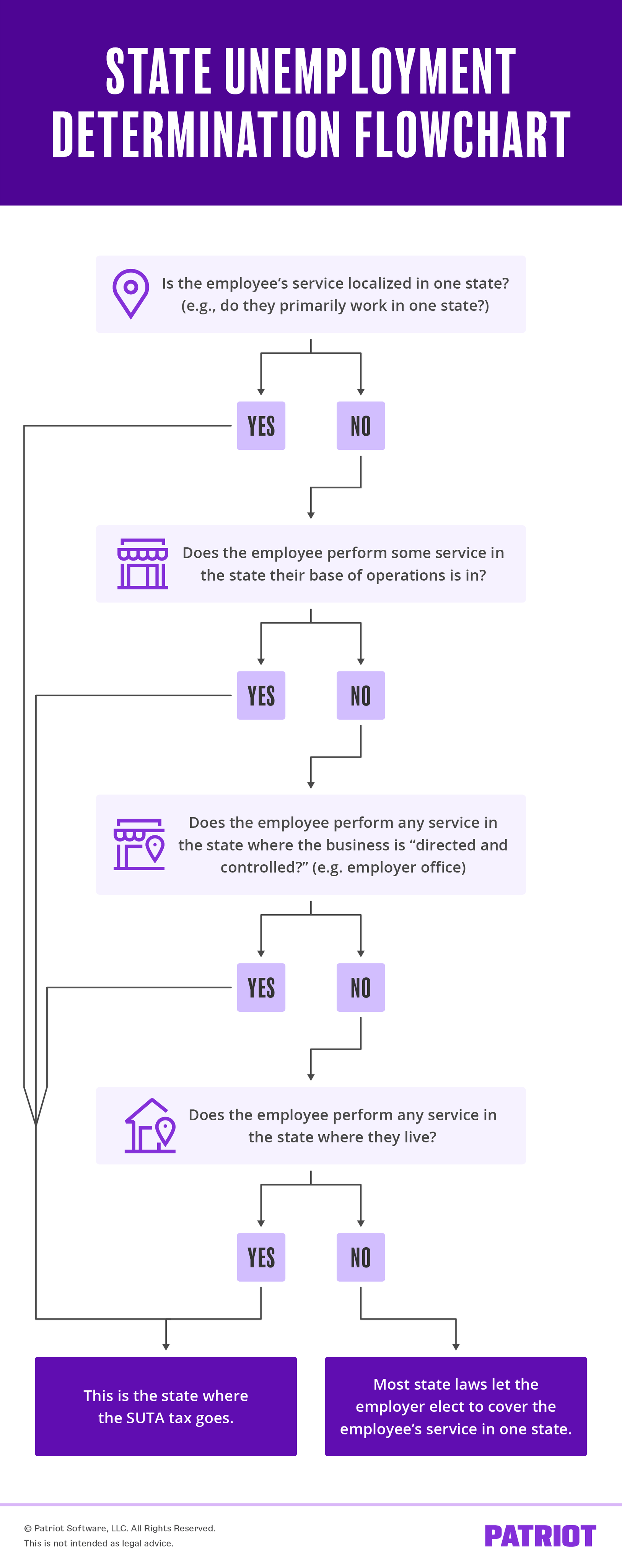

Unemployment Tax Rules For Multi State Employees Suta Tax

Unemployment Tax Rules For Multi State Employees Suta Tax

What Does 3 6 Unemployment Mean For Employers And Job Seekers Solopoint Solutions Inc

Comments

Post a Comment