How Much Taxes Are Taken Out Of My Paycheck

The Medicare tax rate is 145. FICA taxes include Medicare and Social Security taxes which are taxed at a rate of 145 and 62 respectively.

How To Understand Your Paycheck And Meet Your Tax Goals

How To Understand Your Paycheck And Meet Your Tax Goals

Next add in how much federal income tax has already been withheld year-to-date.

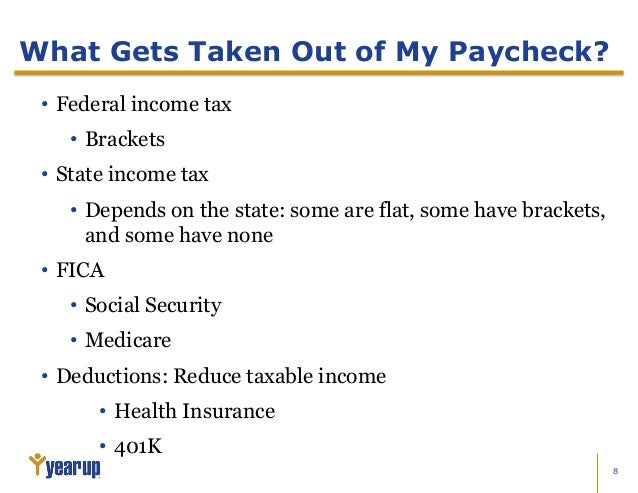

How much taxes are taken out of my paycheck. Every employer in the United States is expected to use information provided on the Form W-4 as well as the amount of the taxable income and how frequently you are paid in order to determine how much federal income tax withholding FITW to withhold from each pay. You also pay Medicare tax and Social Security tax. Tax Withholding Estimator.

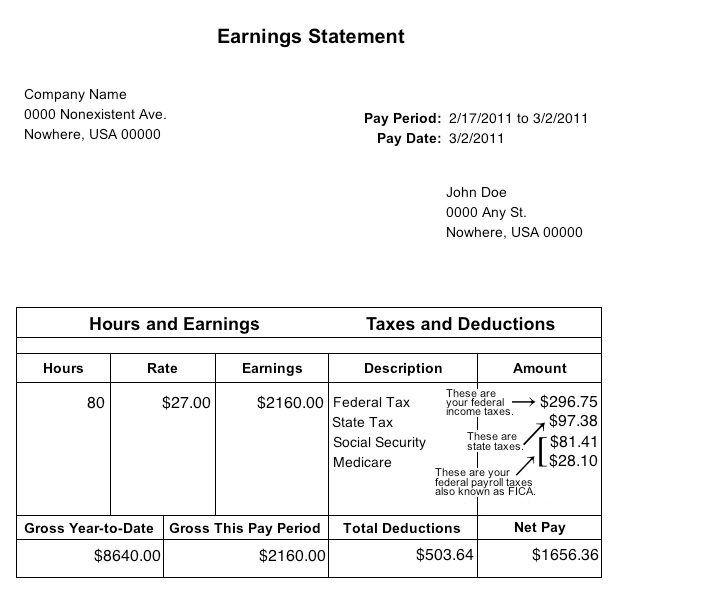

As of 2014 the Social Security tax rate is 62 percent and Medicare tax rate is 145 percent. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

Federal income tax isnt the only tax taken out of your pay. FICA contributions are shared between the employee and the employer. We crunch the numbers and give you a rundown of the paycheck amount and how much to deduct for things like social security medicare tax withholding including federal income tax and local taxes and voluntary deductions.

Its 12400 for single and married filing separately taxpayers and 18650 for those filing as head of household. No matter which state you call home. Your payer works out how much tax to withhold based on information you provide in your Tax file number declaration and Withholding declaration.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Select your location and add a salary amount to find out how much federal and state taxes will be deducted from your paycheck. FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Ad Search Pay Back Taxes Online. If you earn over 200000 youll also pay a 09 Medicare surtax.

Amount taken out of an average biweekly paycheck. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. FICA taxes consist of Social Security and Medicare taxes.

Its a cinch to get started enter your employees pay information and well do the rest for you instantly. Here youll find free hourly and salary paycheck calculators. If you are employed youre going to get taxes withheld from each paycheck.

Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Most people will typically just claim the standard deduction. Add your state federal state and voluntary deductions to determine your net pay.

Federal Income Tax. These taxes together are called FICA taxes. Withholding rates are calculated on the basis that if your pay and circumstances remain consistent throughout the year you may be entitled to a small refund when you complete your tax return at the end of the financial year.

Your Federal Insurance Contribution Act FICA taxes consist of Social Security and Medicare. Total income taxes paid. The standard deduction for 2020 is 24800 for married taxpayers filing jointly.

Whoever you work for will withhold FICA taxes and federal income taxes from your pay. For 2021 employees will pay 62 in Social Security on the first 142800 of wages. These amounts are paid by both employees and employers.

Get Results from 6 Engines at Once. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay.

4 Taxes That are Taken Out of a Paycheck in the United States. Amount taken out of an average biweekly paycheck. In addition to income taxes youll notice some other taxes taken out of your paycheck.

The rate for Medicare is 145 percent. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2021 is 142800 up from 137700 in 2020. Both taxes are applied to your gross income before taking off withholding allowances.

A taxpayer who claims exempt on a W-4 form turned into an employer has Social Security and Medicare taxes taken out of a regular paycheck according to the Internal Revenue Service. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. Get Results from 6 Engines at Once.

If you are an employee your employer pays half of your Social Security taxes or 62 percent and you pay the other half out of your gross wages. Can be used by salary earners self-employed or independent contractors. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year.

Ad Search Pay Back Taxes Online.

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Your Paycheck Tax Withholdings And Payroll Deductions Explained

How To Explain Paycheck Withholdings Deductions Contributions To Your Employees Score

How To Explain Paycheck Withholdings Deductions Contributions To Your Employees Score

How Much Of My Paycheck Goes To Taxes Calculator

Lesson 34 Financial Literacy And Understanding Your Paycheck

Lesson 34 Financial Literacy And Understanding Your Paycheck

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Credit Com

Understanding Your Paycheck Credit Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

5 Taxes That Come Out Of Every Paycheck Mrmillennialmoney

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Free Online Paycheck Calculator Calculate Take Home Pay 2021

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Understanding Withholding Taxes Police My Money

Comments

Post a Comment